-

Company Info

-

Business Information

-

Sustainability

-

IR NEWS

The Glosel Group strives to promote businesses that contribute to the reduction of greenhouse gases and the mitigation of climate change to realize a decarbonized society.

In November 2022, the Glosel Group expressed its support for the recommendations of the Task Force

on Climate-related Financial Disclosures (TCFD). Based on TCFD’s recommendations, we will actively promote the disclosure of information on governance,

strategy, risk management, and indicators and targets regarding climate change-related risks and opportunities.

In November 2022, the Company expressed its support for the recommendations of the “Task Force

on Climate-related Financial Disclosures (hereinafter referred to as “TCFD”) established by the

Financial Stability Board (FSB). We will continue to strive to enhance our disclosure in line with the TCFD framework.

[1] Corporate governance system

The Glosel Group places the utmost priority on enhancing corporate governance to improve management transparency and strengthen corporate management. In addition, we establish an organizational structure capable of responding quickly to changes in the business environment and take necessary measures in order to enhance and develop our corporate value.

[2] Sustainability promotion system

The Company regards climate change-related issues as a key management issue and has established a Sustainability Committee, chaired by the President, Representative Director to discuss policies, risks, opportunities, and strategies. The Sustainability Committee is appropriately managed and supervised by the Board of Directors, and management is actively involved in managing progress. Matters discussed by the Sustainability Committee are regularly submitted to the Management Meeting and the Board of Directors.

Board of Directors

Submission/report

Supervision/instruction

Management Meeting

Submission/report

Supervision/instruction

Sustainability Committee

Chairperson: President/Promotion member: Full-time fellow

Advisor: Outside director

Sustainability Secretariat

Environment WG

Efforts to achieve carbon neutrality

Technology WG

Efforts to resolve social issues by

outstanding products and technology

Human Resources WG

Promotion of diversity and inclusion

Governance WG

Enhancement of corporate governance system

and promotion of thorough compliance

Each department and group company

[3] Board of Directors

Policies, risks, opportunities, and strategies discussed by the Sustainability Committee are regularly placed on the agenda and reported, and progress management and oversight of sustainability activities are conducted. In addition, the Board makes final decisions and supervises important matters in response to climate-related issues in its management policies, annual business plan, and medium-term business plan.

[4] Management Meeting

Policies, risks, opportunities, and strategies discussed by the Sustainability Committee are regularly placed on the agenda and reported, and progress management and oversight of sustainability activities are conducted.

[5] Sustainability Committee

Chaired by the President, Representative Director and participated by outside directors, the Committee deliberates and makes recommendations on basic policies, strategies and important issues related to sustainability. We are also working to improve the effectiveness of sustainability management and enhance communication with stakeholders.

[6] Working Group

Four working groups have been established under the Sustainability Committee: The Environment WG, Technology WG, Human Resources WG, and Governance WG. The Environment WG holds regular meetings with the mission of planning and promoting initiatives to achieve carbon neutrality. Regular meetings also include analysis of climate-related risks and opportunities, from the calculation and reduction of GHG emissions, and consideration of policies and measures.

[1] Overview

The Glosel Group has established the Risk Management Committee to take early response and prompt corrective action when risk signals are detected.

All risks, including those related to climate change, are assessed, discussed and reported twice a year by the Directors, Corporate Officers, and General Managers or the equivalent positions in the Risk Management Committee chaired by the President, Representative Director, and once a quarter by the Management Meeting and Board of Directors in the Sustainability Committee.

[2] Risk management

With regard to the identified risks, we identify, classify, analyze, and assess the risk of a crisis, and check the status of compliance with the identified risks. We also work with the relevant supervising departments to establish measures before and after a crisis occurs. In addition, in order to understand and assess the impacts and risks posed by climate change, we conduct scenario analysis, consider measures to minimize risks, and manage them appropriately.

[1] Assessment, identification, and management of climate change risks and opportunities

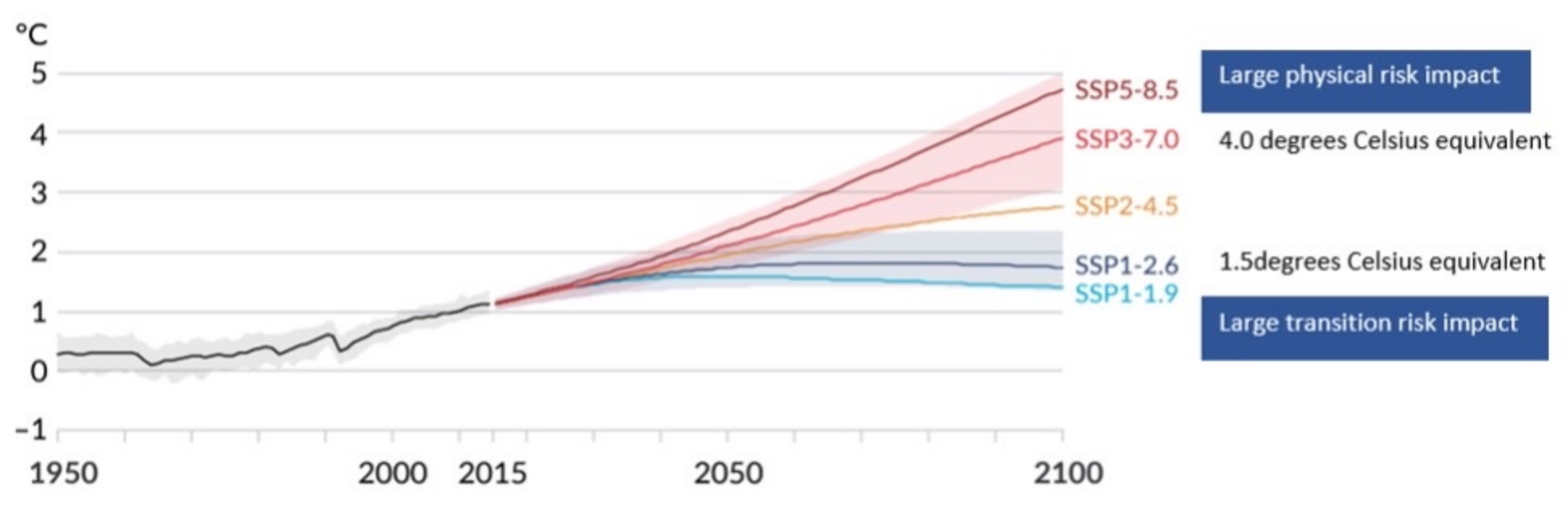

With regard to climate change, we are looking at what we can do to recognize the risks and opportunities and lead to risk reduction and opportunities. Progress management is based on indicators and targets set to promote measures to address climate change-related risks. We also conducted risk assessments based on 1.5°C and 4°C scenarios to understand and assess the impacts of climate change-related impacts. Based on these results, we identify opportunities (turn risks into opportunities), examine business initiatives, and manage progress.

[1] Methods for analyzing climate-related risks and opportunities

With regard to climate change scenarios, various international organizations have developed multiple climate change scenarios that they expect to occur by 2100. In considering policies and measures to identify and prepare for the risks of climate change on our businesses and the Company, we used the NZE2050 scenario of the International Energy Agency (IEA), the global warming scenario described in the 6th assessment report of the UN Intergovernmental Panel on Climate Change (IPCC) (SSP1-1.9), and the global warming scenario described in the 5th assessment report (RCP2.6-RCP8.5) to analyze the impact on the Company.

Change in global average temperature relative to 1850 to 1900

Source: IPCC, Climate Change 2021: The Physical Science Basis

https://www.ipcc.ch/report/sixth-assessment-report-working-group-i/

“Climate Change 2021 The Physical Science Basis (p. 22)” IPCC

https://report.ipcc.ch/ar6/wg1/IPCC_AR6_WGI_FullReport.pdf

[2] Climate-related risks and opportunities

We examined the impact of each scenario on the Glosel Group and analyzed climate-related risks and opportunities.

| Scenario category | Climate-related risks | Potential fiscal impact | Duration | Evaluation | ||

|---|---|---|---|---|---|---|

| 1 . 5 °C |

Transition risk |

Policy/ |

Higher carbon taxes |

Higher procurement and logistics costs from higher carbon taxes |

Medium |

Large |

Regulations on carbon emissions and the use of fossil fuels |

Decrease in sales of existing internal-combustion engine auto parts due to the shift from gasoline vehicles to EVs and FCVs |

Medium |

Medium |

|||

Technology |

Widespread use of next-generation technologies |

Increased development costs for environmentally friendly improvements to STREAL products |

Short |

Medium |

||

Market |

Customer behavior change |

Decrease in orders if we are unable to respond to customer requests to reduce CO2 emissions in the entire supply chain |

Medium |

Large |

||

Reputation |

Appraisal from investors |

Decline in corporate value, such as a decline in stock prices due to a bad reputation |

Medium |

Small |

||

| 4 °C |

Physical |

Acute |

Frequent occurrence of natural disasters |

Possibility of disruption to stable procurement due to supply chain disruption or long-term infrastructure outage |

Medium |

Small |

| Scenario category | Climate-related opportunities | Potential fiscal impact | ||

|---|---|---|---|---|

| 1 . 5 °C or less |

Opportunity |

Products and |

Energy-saving measures |

Increase in opportunities for manufacturing process efficiency due to energy-saving measures, communication infrastructure due to IoT, and cloud businesses |

Energy-saving measures |

Expansion of telecommunications business, including the construction of next-generation information and telecommunications infrastructure such as 5G, in line with digitization of society |

|||

Energy-saving measures |

Growing demand for tools (software) to manage environmental initiatives, including disclosure of information for corporate ESG investments, such as responses to the Law to Promote Global Warming Countermeasures, Energy Saving Act, SDGs, TCFD, and CDP, and electricity cost reduction |

|||

Business change |

Growing demand for semiconductors and electronics parts we handle due to the electrification of automobiles |

|||

Creation of |

Development of new markets by strengthening collaboration with partners |

Expansion of business opportunities due to growing demand for storage and power supply products for the data center market |

||

| Scenario category | Climate-related opportunities | Potential fiscal impact | ||

|---|---|---|---|---|

| 1 . 5 °C or less |

Opportunity |

Products and |

Energy-saving measures |

Expansion of environment-friendly capital investment to save energy and improve efficiency |

Expansion of needs for |

Acceleration of initiatives to achieve global carbon neutrality by each country Acceleration and growing demand for capital investment in renewable energy |

|||

Diversification of means of transportation |

Growing demand for low-carbon transportation. At the same time, growing demand for familiar e-bikes. |

|||

Needs to respond to natural disasters |

Growing demand for constant monitoring systems for infrastructure resilient to natural disasters |

|||

Duration: Short: 5 years or less, Medium: More than 5 years to 10 years or less, Long: 10 years or more

Evaluation: Large JPY 300 million or more, Medium: JPY 100 million or more and less than JPY 300 million, Small: less than JPY 100 million (on a profit basis)

[1] Scenario analysis

As for scenario analysis, the International Energy Agency’s (IEA) NZE2050 scenario states that one of the prerequisites for achieving 2050 carbon neutrality is that 60% of vehicle sales will be electric vehicles (hereafter, EV) by 2030. Demand for semiconductors and electronics parts such as power semiconductors, various sensors, and all-solid-state batteries is expected to increase with the shift to EVs and the expected advent of an autonomous driving society in the future.

In addition, in response to society’s demand for energy saving, the increasing efficiency of manufacturing processes and the shift to the Internet of Things (IoT) will lead to greater investment in the telecommunications infrastructure that supports sensors and the communications environment, and demand for semiconductors is expected to grow significantly. Moreover, regardless of the 4°C and 1.5°C scenarios, social needs for resource extraction and preventive maintenance, which will reduce waste, are expected to expand not only in terms of long-term effective use of social infrastructure and cost, but also in terms of resource recycling. The development of measurement and monitoring technologies is essential for the advancement of preventive maintenance, and demand for semiconductors is expected to increase.

[2] Results of scenario analysis

The Company’s major customers are automotive and industrial equipment companies, and its suppliers are positioned to be highly environmentally responsible. On the other hand, demand for semiconductors, which are the main commercial materials handled, is expected to continue to grow significantly in the trend toward EVs, labor-saving, and energy-saving.

In the 4°C scenario, frequent and severe natural disasters may disrupt stable procurement due to disrupted supply chains and long-term infrastructure outages, but we will reduce these risks by reviewing and strengthening our BCP response to the global procurement network as appropriate.

In the 1.5°C scenario, there is a risk that the increase in the carbon tax will increase energy costs, as well as procurement and logistics costs affected by the increase, but we will work to reduce this risk by promoting CO2 reduction throughout the supply chain. We also recognize the risk of a decline in orders if we are unable to calculate and reduce CO2 emissions as requested by our customers and end product manufacturers, and if we are unable to provide appropriate guidance to our suppliers. Therefore, we will strive to understand the actual situation of CO2 emissions appropriately and strengthen our management system.

In the 1.5°C scenario, we believe that the impact on our business environment could be a significant opportunity, not just a risk. In the semiconductor products business, demand for semiconductors and electronics parts such as power semiconductors, various sensors, and all-solid-state batteries is expected to increase due to the expansion of EVs and autonomous driving, and business opportunities are expected to expand. Therefore, we will strengthen our sales structure for the EV market and expand new products such as next-generation power semiconductors. In addition, we will establish new business models such as cloud business, expand communications device products, and strengthen our support system, as we expect to increase the efficiency of manufacturing processes in line with energy-saving measures, increase opportunities for telecommunications infrastructure and cloud business due to IoT, and expand telecommunications businesses such as the construction of next-generation information and communications infrastructure such as 5G due to DX. In addition, to create new businesses, we will strengthen cooperation with our partners and expand business opportunities by increasing demand for storage and power supply products (power supply modules, electronics parts, etc.) for the data center market. Moreover, since growing demand for tools (software) to manage environmental initiatives, including disclosure of information for corporate ESG investments, such as responses to the Law to Promote Global Warming Countermeasures, Energy Saving Act, SDGs, TCFD, and CDP, and electricity cost reduction are expected, we will propose and sell EcoAssist-Enterprise-Light, an environmental information management solution of Hitachi, to our customers.

Further, we recognize that the expansion of environment-friendly capital investment to achieve energy saving and higher efficiency will provide a great opportunity for our company. Our own STREAL is a high-performance product (small size, high resolution, low power consumption) with no comparable products. Mounting STREAL on a robot to detect various forces generated in the robot will enable advanced robot control. More efficient robot operation will improve productivity and reduce operation time. As a result, we believe we can contribute to the reduction of energy consumption. Additionally, as countries accelerate their initiatives to achieve global carbon neutrality, capital investment for renewable energy is accelerating, and demand for wind power is also expanding. Going forward, we will capture the demand for sensing by STREAL due to the increase in the number of windmills installed. In addition, as demand for low-carbon transportation expands, we expect demand for familiar e-bikes to grow, and we are considering capturing the growing demand for e-bikes. Furthermore, with the growing demand for constant monitoring systems for infrastructure resistant to natural disasters, the strain monitoring system that can cope with severe external conditions can detect infrastructure anomalies in advance. We will contribute to the longevity of existing infrastructure through predictive maintenance.

[3] Impact of climate-related risks and opportunities on business, strategy, and financial planning

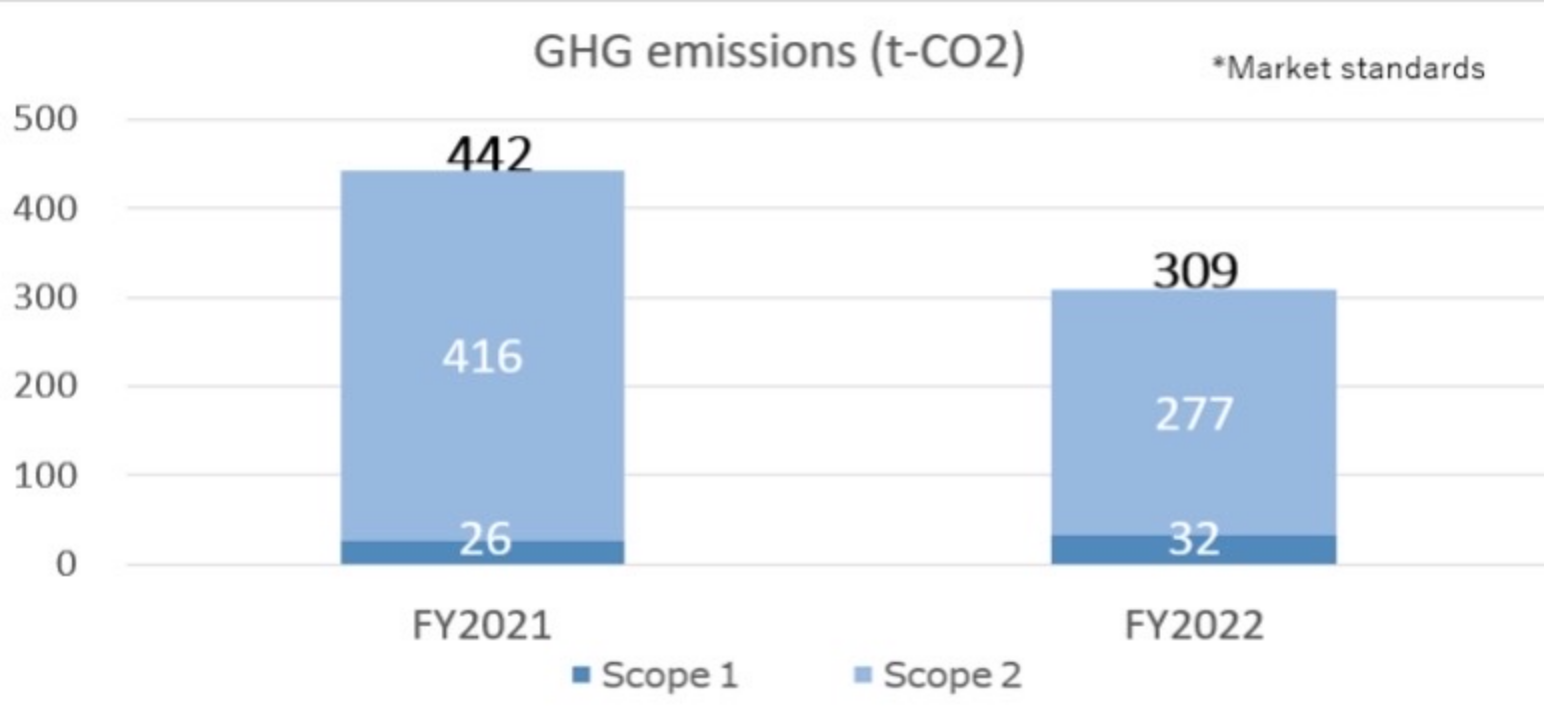

We consider the impact of the carbon tax to be minor, at JPY 7 million, based on the current GHG emissions of 442 t-co2 (total of Scope 1 and 2) and the NZE2050 scenario (2030 carbon tax of USD 130/t-co2).

In terms of business opportunities, we have launched specific initiatives by formulating a basic strategy in our medium-term management plan, Project “S.” In semiconductor products and electronics parts, we plan to increase sales by contributing to the electrification of vehicles and development of ADAS (advanced driver assistance systems) by enhancing our strengths in software development and on-site support.

As for STREAL sales, we will work to increase sales by entering the market for energy-saving equipment and renewable energy, mainly related to industrial robots, wind power generation, and predictive maintenance of infrastructure.

[1] Overview

We set indicators and targets in our medium-term management plan, “Project ‘S’ (Basic Strategy),” and initiatives for materiality of the Company to manage progress.

[1] Performance

Scope 1 and 2 GHG emissions are as follows. Unit: (t-CO2)

| Fiscal year ended March 2022 | Fiscal year ended March 2023 | |

|---|---|---|

| Scope 1 | 26 |

32 |

| Scope 2 (market based) | 416 |

277 |

| Scope 2 (location based) | 413 |

368 |

| Total: Scope 1 + 2 (market based) | 442 |

309 |

[2] Reduction target

At the climate summit (held online) hosted by the United States on April 22, 2021, in light of the decision of the Global Warming Prevention Headquarters, the Japanese government announced that it would aim to reduce greenhouse gases by 46% from fiscal 2013 levels by fiscal 2030, as an ambitious goal consistent with carbon neutrality in 2050, and that it would continue to challenge the 50% level. In response to this, the Company has also set a carbon neutral reduction target for 2050 and a reduction target of at least 50% for 2030, based on the fiscal year ending March 2022, for the combined total of Scope 1 and Scope 2 market standards.

We will continue to promote thorough energy-saving activities and the active use of renewable energy.

• Boundary has adopted the control approach (financial control) and is a consolidated company that includes overseas subsidiaries. Carbon dioxide (CO2), an energy-derived greenhouse gas, and non-energy-derived greenhouse gases are included in the calculation.

• The energy used in Scope 1 is gasoline, which is calculated by multiplying the amount used by each sales vehicle by the emissions intensity. The Ministry of the Environment’s “List of Calculation Methods of Emission Factors in the Calculation, Reporting, and Publication System” is used for emissions intensity. As for non-energy-derived GHG, there is no activity subject to calculation.

• The energy used in Scope 2 is electricity, which is calculated by multiplying the electricity used by each office by the emissions intensity. The Ministry of the Environment’s “Emission Factor by Electric Power Provider” is used for emissions intensity. There is no use of steam, hot or cold water.

The Glosel Group recognizes that the reduction of greenhouse gases is an essential initiative, and to achieve carbon neutrality by 2050, we will strive to visualize CO2 emissions, address various issues, and use our technological and procurement capabilities to reduce them.

The Glosel Group strives to save energy through ISO14001 activities and is promoting initiatives to reduce GHG emissions under a company-wide framework, including air conditioning management, recycling through waste separation, switching from fluorescent to LED lighting, and introduction of solar panels and renewable energy.

The Glosel Group is working to improve logistics with low environmental impact and is promoting the realization of a decarbonized society. To reduce the environmental impact, we are working to reduce CO2 emissions by reducing the amount of discarded packaging materials for semiconductors and electronics part, and by reusing tray materials.